All Categories

Featured

Table of Contents

You may be asked to make extra premium repayments where coverage might terminate due to the fact that the rates of interest dropped. Your beginning passion price is dealt with just for a year or in many cases three to five years. The assured rate offered for in the policy is a lot lower (e.g., 4%). Another function that is often emphasized is the "no charge" financing.

In either situation you should receive a certificate of insurance describing the arrangements of the team policy and any kind of insurance fee - which of the following best describes the term life insurance. Normally the maximum quantity of coverage is $220,000 for a home loan and $55,000 for all various other financial debts. Credit rating life insurance policy need not be bought from the organization providing the funding

A Term Life Insurance Policy Matures When

If life insurance policy is called for by a lender as a problem for making a funding, you may have the ability to assign an existing life insurance policy policy, if you have one. You may desire to purchase group credit scores life insurance policy in spite of its higher cost due to the fact that of its convenience and its availability, normally without detailed proof of insurability - what does the term illustration mean when used in the phrase life insurance policy illustration.

Most of the times, nonetheless, home collections are not made and premiums are mailed by you to the representative or to the business. There are certain elements that tend to increase the prices of debit insurance greater than routine life insurance policy strategies: Particular costs are the exact same no issue what the size of the policy, so that smaller plans issued as debit insurance will have greater costs per $1,000 of insurance policy than bigger dimension regular insurance policies

Questions To Ask About Term Life Insurance

Because very early lapses are pricey to a business, the costs need to be passed on to all debit insurance holders. Because debit insurance is designed to include home collections, higher payments and charges are paid on debit insurance coverage than on regular insurance coverage. In a lot of cases these greater expenditures are passed on to the insurance holder.

Where a business has various costs for debit and regular insurance policy it may be possible for you to acquire a larger amount of regular insurance coverage than debit at no added cost. If you are believing of debit insurance, you ought to absolutely investigate normal life insurance coverage as a cost-saving option.

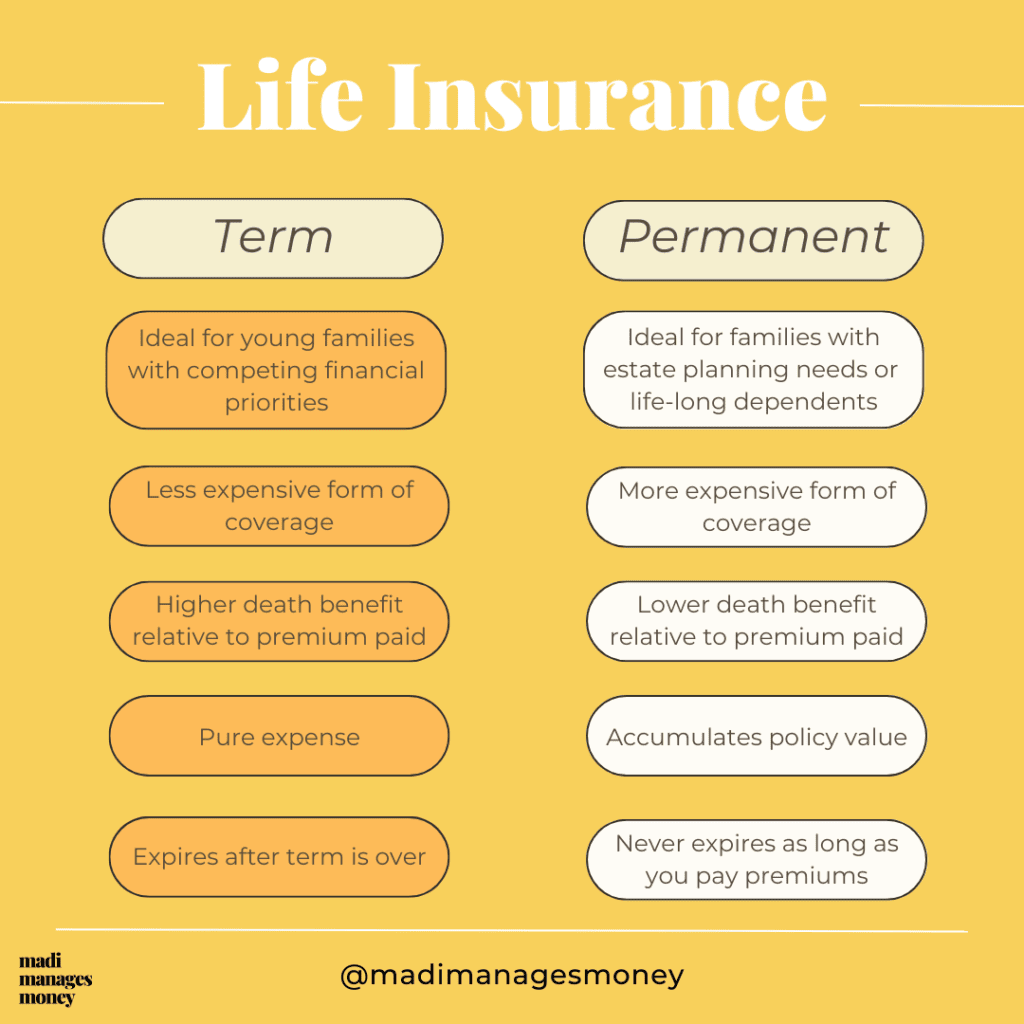

This strategy is created for those who can not originally manage the routine entire life premium however who want the greater costs insurance coverage and feel they will become able to pay the higher premium - compare decreasing term life insurance. The household policy is a combination plan that gives insurance coverage security under one agreement to all participants of your prompt family members husband, wife and youngsters

Joint Life and Survivor Insurance offers coverage for 2 or even more individuals with the fatality advantage payable at the death of the last of the insureds. Premiums are dramatically reduced under joint life and survivor insurance coverage than for plans that guarantee just one individual, considering that the likelihood of needing to pay a fatality claim is reduced.

Costs are dramatically more than for policies that guarantee a single person, given that the likelihood of having to pay a death insurance claim is higher - does term life insurance cover disability. Endowment insurance policy offers the settlement of the face total up to your beneficiary if fatality happens within a details time period such as twenty years, or, if at the end of the details period you are still alive, for the settlement of the face quantity to you

Latest Posts

Level Term Life Insurance Definition

Top 10 Final Expense Insurance Companies

Which Of The Following Best Describes Term Life Insurance?